Business Central Accounting Software Explained: A Complete ERP Accounting Guide for Modern Finance Teams

Introduction: The New Age of Accounting Software ERP

The right accounting system can make or break a business’s ability to grow, forecast accurately, and stay compliant. Gone are the days of juggling spreadsheets and disconnected systems. Today, finance leaders from CFOs to accountants and business owners are turning to Business Central accounting software, Microsoft’s all-in-one accounting software ERP solution designed to unify financial management, operations, and reporting.

Whether you’re managing cash flow, reconciling accounts, or preparing for your next audit, Dynamics 365 Business Central simplifies and automates your financial processes while providing real-time visibility across your organization.

This guide explores the key features, benefits, and reasons why Business Central accounting software stands out as the preferred ERP choice for small to medium-sized enterprises (SMEs) and growing finance teams.

1. Understanding Business Central Accounting Software

What is Microsoft Dynamics 365 Business Central?

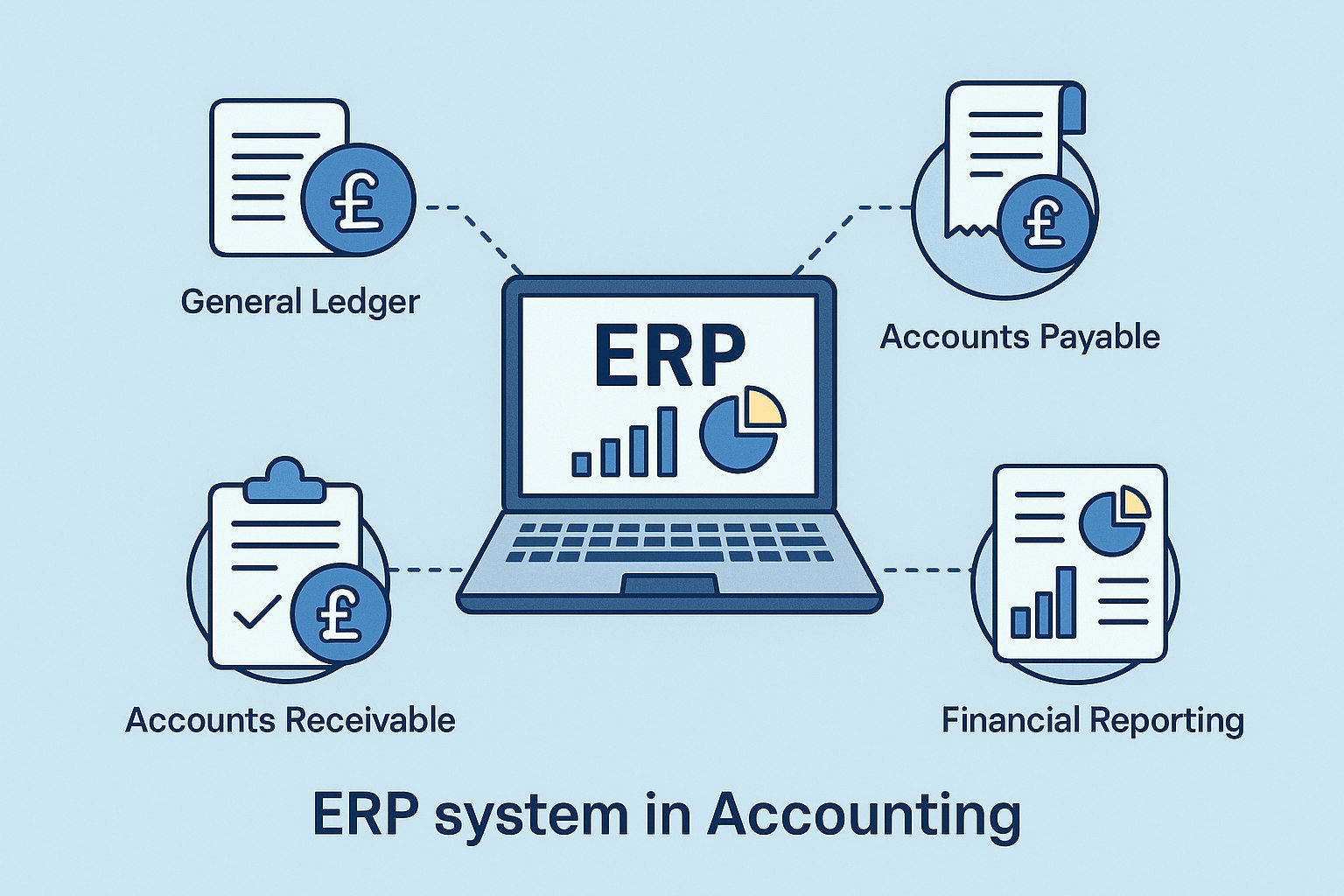

Microsoft Dynamics 365 Business Central is an enterprise resource planning (ERP) solution tailored for small and mid-sized businesses. It goes beyond basic accounting by integrating financial management, supply chain, sales, and operations into one unified system.

Unlike traditional accounting software, Business Central connects every part of your organization, from invoices to inventory, payroll to procurement, in one centralized platform.

Why Businesses Choose Business Central

- Comprehensive financial management for all core accounting functions

- Scalability as your organization grows

- Integration with Microsoft 365, Power BI, and Azure for enhanced insights

- Cloud-based accessibility for hybrid and remote teams

- Regulatory compliance through localized accounting and tax standards

It’s not just software; it’s the backbone of digital transformation for finance-driven organizations.

2. The Evolution from Traditional Accounting to ERP

The Problem with Legacy Accounting Systems

Traditional accounting tools often limit financial visibility. Manual data entry, siloed systems, and lack of automation create inefficiencies and errors that compound over time.

Common challenges include:

- Duplicate data entry across systems

- Limited real-time insights

- Difficulties managing multi-entity operations

- Manual reconciliation processes

How ERP Solves These Problems

Accounting software ERP solutions like Business Central offer a connected ecosystem. All financial and operational data flows through a single system, giving finance teams a 360° view of the business in real time.

With Business Central, you’re not just tracking numbers; you’re managing performance, forecasting outcomes, and improving decision-making.

3. Core Financial Management Features

General Ledger (GL) Automation

The General Ledger is the foundation of financial control. Business Central automates entries, manages multiple dimensions, and supports real-time posting, ensuring accurate reporting every time.

Key capabilities:

- Multi-dimensional chart of accounts

- Automated posting of transactions

- Real-time consolidation across departments

- Full audit trails for compliance

Accounts Payable (AP) & Receivable (AR)

Automate invoice processing, streamline payments, and track overdue balances effortlessly.

With Business Central accounting software, you can:

- Automatically match invoices to purchase orders

- Manage vendor terms and early payment discounts

- Send automated reminders for outstanding customer invoices

- Handle multicurrency transactions with ease

Bank Reconciliation & Cash Flow Management

Connect bank feeds, automate reconciliation, and gain a real-time view of your cash position.

Business Central offers:

- Automated bank reconciliation

- Predictive cash flow forecasting

- Integration with banking APIs

- Visibility into future liquidity and cash requirements

4. Advanced Financial Capabilities for Growth

Fixed Asset Management

Track and manage fixed assets throughout their lifecycle, from acquisition to depreciation and disposal.

Business Central’s fixed asset module ensures accurate depreciation calculations and compliance with IFRS and GAAP.

Multi-Currency & Multi-Entity Consolidation

Operate globally with confidence. Manage multiple currencies, tax structures, and subsidiaries within one environment.

Key benefits:

- Real-time currency conversion

- Consolidated reporting across entities

- Localization packs for tax compliance

Budgeting & Forecasting

Plan with precision using built-in budgeting tools or connect with Power BI for advanced analytics.

Finance leaders can create multiple budget versions, compare actuals vs. budgets, and identify trends instantly.

5. Integration with Microsoft 365 and Power BI

The synergy between Business Central accounting software and Microsoft 365 is one of its biggest differentiators.

You can:

- Edit and share reports directly in Excel

- Collaborate via Teams and Outlook

- Automate workflows with Power Automate

- Gain deep insights through Power BI dashboards

This seamless integration boosts productivity and ensures everyone works from the same source of truth.

6. Real-Time Financial Reporting and Analytics

Custom Dashboards

Business Central provides intuitive dashboards that visualize your KPIs, from profit margins to overdue invoices.

AI-Driven Insights

Microsoft’s AI engine identifies anomalies, predicts overdue payments, and highlights cost-saving opportunities.

Audit & Compliance Reporting

Stay audit-ready at all times with traceable transaction histories and configurable reports that meet statutory requirements.

7. Industry-Specific Accounting Functionality

One of the biggest strengths of Business Central accounting software is its flexibility. It’s not a one-size-fits-all tool; it’s designed to adapt to the unique financial and operational needs of different industries.

Here’s how it supports key sectors:

Manufacturing

Manufacturers can manage job costing, production accounting, and material usage seamlessly. Business Central connects your shop floor with your financials, giving real-time insight into production costs and profitability.

Retail and eCommerce

For retailers and online sellers, Business Central integrates sales, purchasing, and inventory. It enables accurate inventory valuation, connects with POS systems, and helps track margins across multiple sales channels.

Professional Services

Consultants and service providers benefit from project accounting features. You can track time and expenses, manage project budgets, and invoice clients accurately, ensuring every billable hour counts.

Construction and Engineering

Construction firms can handle complex project costing, retention payments, and subcontractor management in one system. Business Central provides visibility into project profitability and cash flow at every stage.

Logistics and Distribution

For logistics providers, the system streamlines warehouse management, order fulfillment, and inventory tracking. You can monitor stock levels in real time, reduce overstocking, and improve delivery accuracy.

Financial Services

Finance and insurance businesses can use Business Central to handle regulatory reporting, compliance management, and risk control. Automated workflows and audit trails ensure data accuracy and transparency.

8. The Cloud Advantage: Accessibility & Security

Work Anywhere, Anytime

Access your financial data from any device, whether you’re in the office, on-site, or abroad.

Security and Compliance

Microsoft’s Azure infrastructure ensures enterprise-grade security, encryption, role-based access control, and automatic backups.

Certifications include: ISO 27001, GDPR compliance, and SOC 2.

For finance professionals, this means peace of mind and reliability.

9. Automation and Artificial Intelligence in Business Central

AI-Powered Accounting

Automation eliminates repetitive tasks like invoice data entry, bank reconciliation, and expense classification.

Business Central leverages AI and machine learning to:

- Detect anomalies in transactions

- Recommend journal corrections

- Predict late payments

- Suggest cost optimizations

Saving Time for Strategic Finance

By automating the mundane, finance teams can shift focus from bookkeeping to strategy, forecasting, and business improvement.

10. User Experience and Scalability

Business Central’s intuitive interface mirrors Microsoft 365, familiar, simple, and easy to use.

Scalability advantages:

- Add new users and entities instantly

- Integrate with third-party tools

- Upgrade features as your business evolves

Whether you’re a growing SME or an established organization, the platform grows with you.

11. Implementation and Support: The Partner Advantage

Implementing an ERP system can feel daunting; that’s where certified Microsoft partners like NetMonkeys come in.

A successful deployment requires:

- Process mapping to align software with business goals

- Data migration from legacy systems

- User training and support for adoption

- Ongoing maintenance and optimization

Choosing an experienced partner ensures a smooth transition and measurable ROI.

12. Cost Efficiency and Return on Investment

Subscription-Based Pricing

Business Central operates on a flexible SaaS model, pay only for what you use.

Lower IT Overhead

No need for servers, on-premises maintenance, or manual updates.

Quick ROI

Many businesses report a return on investment within 6–12 months through improved efficiency, reduced errors, and faster reporting cycles.

13. Comparing Business Central to Other Accounting Software

When evaluating Business Central accounting software, it’s helpful to understand how it compares to other popular tools such as QuickBooks, Xero, and Sage 200.

ERP Capabilities

Unlike QuickBooks and Xero, which focus mainly on bookkeeping and small business finance, Business Central offers a full ERP suite. That means it goes beyond accounting to include inventory, supply chain, project management, and operations; all connected within one system. Sage 200 provides partial ERP functionality, but it lacks the same level of depth and native Microsoft integration.

Integration with Microsoft Tools

Business Central integrates seamlessly with Microsoft 365, Outlook, Teams, and Power BI. In contrast, QuickBooks and Xero have little or no native Microsoft integration and rely on third-party connectors. Sage 200 can integrate with Microsoft tools, but not as fluidly or intuitively.

Multi-Entity and Multi-Currency Management

For businesses operating across multiple subsidiaries or regions, Business Central allows you to manage multi-entity and multi-currency accounting in real time. QuickBooks and Xero lack this capability, while Sage 200 provides it in a more limited form.

Automation and AI

Microsoft has embedded AI and automation deeply into Business Central. The system can automate reconciliations, detect anomalies, and predict late payments. QuickBooks and Xero offer some automation, but it’s basic, while Sage 200’s AI capabilities remain modest.

Scalability

Business Central is designed to grow with your business. It can support small start-ups and expand into enterprise-level operations. QuickBooks and Xero are typically suited for smaller companies, and Sage 200 sits somewhere in the middle.

The Verdict

If your goal is simply to manage everyday bookkeeping, tools like Xero or QuickBooks might suffice; however, if you need an advanced accounting software ERP that unifies your finances, operations, and analytics in one intelligent platform, Microsoft Dynamics 365 Business Central stands far ahead of the competition.

14. Key Benefits Summary

Let’s recap the core benefits of Business Central accounting software:

- Unified financial and operational data

- Automation of accounting processes

- Accurate, real-time reporting

- AI-driven forecasting and insights

- Scalable ERP architecture

- Seamless integration with Microsoft tools

- Industry-specific adaptability

- Enhanced security and compliance

It’s more than accounting software; it’s a complete digital finance ecosystem.

15. Building Financial Resilience with Business Central

In uncertain markets, resilience and agility are crucial. Business Central helps organizations:

- Maintain liquidity visibility

- Model financial outcomes

- Respond to changing demand

- Strengthen audit and compliance controls

It’s a future-ready ERP platform for data-driven decision-making.

16. Common Misconceptions About Business Central

“It’s too complex for SMEs.” Not true. Business Central is modular; you can start with core finance and expand later.

“Implementation takes too long.” With the right partner, it can go live in weeks, not months.

“It’s just for accountants.” It’s for the entire business; finance, operations, and leadership, enabling collaboration across departments.

17. Real-World Success Stories

Many businesses across manufacturing, retail, and professional services have transformed their finance operations with Business Central accounting software:

- Manufacturing firms reduced month-end closing from 10 days to 3.

- Retail companies improved inventory valuation accuracy by 30%.

- Consultancies achieved real-time billing and project profitability tracking.

These results highlight Business Central’s tangible business impact.

18. The Future of Accounting Software ERP

As AI, automation, and cloud technology evolve, Business Central continues to expand with predictive analytics, embedded Copilot (Microsoft’s AI assistant), and deeper integrations with Microsoft Fabric and Power Platform.

This evolution ensures finance teams stay ahead of the curve in efficiency, compliance, and intelligence.

19. How to Choose the Right Business Central Partner

When selecting a partner to implement or optimize your system, look for:

- Microsoft certification and proven ERP experience

- Industry-specific understanding

- Post-deployment support

- AI and automation expertise

That’s where NetMonkeys stands out.

20. Why Choose NetMonkeys for Your Business Central Journey

At NetMonkeys, we combine over 15 years of IT and software expertise with a deep passion for AI and digital transformation. As a trusted Microsoft partner, we’ve helped countless UK businesses modernize their financial systems with Business Central accounting software.

What We Offer:

- Seamless implementation and data migration

- Tailored configurations for your industry

- End-user training and ongoing support

- AI-powered process optimization

- Integration with Power BI, Teams, and Microsoft 365

We’re not just IT specialists; we’re digital transformation partners who ensure your ERP delivers real business value.

Ready to Transform Your Accounting?

Talk to NetMonkeys today and discover how Business Central can streamline your finance operations, drive smarter decisions, and future-proof your business.

👉 Visit NetMonkeys.co.uk to learn more about our Microsoft Business Central solutions.

Related posts

Visit blog

Choosing the Right Power BI Consultancy in London: Expert Guide

This guide will help you understand what to look for when choosing a Power BI consultancy, the benefits of working with London Power BI Experts, and why partnering with the right London Business Intelligence Consultants is important

How Much Does IT Support Cost for a Small Business? A Complete Guide

IT support encompasses a range of services designed to maintain and optimise technology infrastructure. For small businesses, this can include network management, hardware and software troubleshooting, cybersecurity, cloud services, data backup, and user assistance

ERP Implementation Cost Guide: Key Considerations, Strategies, and Planning Insights

This article explores the main factors that influence ERP implementation expenses, hidden considerations, and strategies for maximising return on investment.