1. Introduction to ERP in Accounting

Enterprise Resource Planning, commonly known as ERP, refers to an integrated suite of software applications that help businesses manage day-to-day operations. While ERP systems are designed to cover a broad range of business functions—from inventory and supply chain management to human resources—their role in accounting is especially critical. For many organisations, the financial module of an ERP system acts as the central nervous system, providing a unified platform to track income, expenses, assets, and liabilities.

In accounting, ERP systems offer more than just basic bookkeeping. They serve as a strategic tool that helps businesses ensure financial compliance, automate transactional processes, and generate real-time financial insights. As companies in the UK shift towards digital transformation, ERP accounting software such as Microsoft Dynamics 365 Business Central is becoming a staple in both SMEs and larger enterprises.

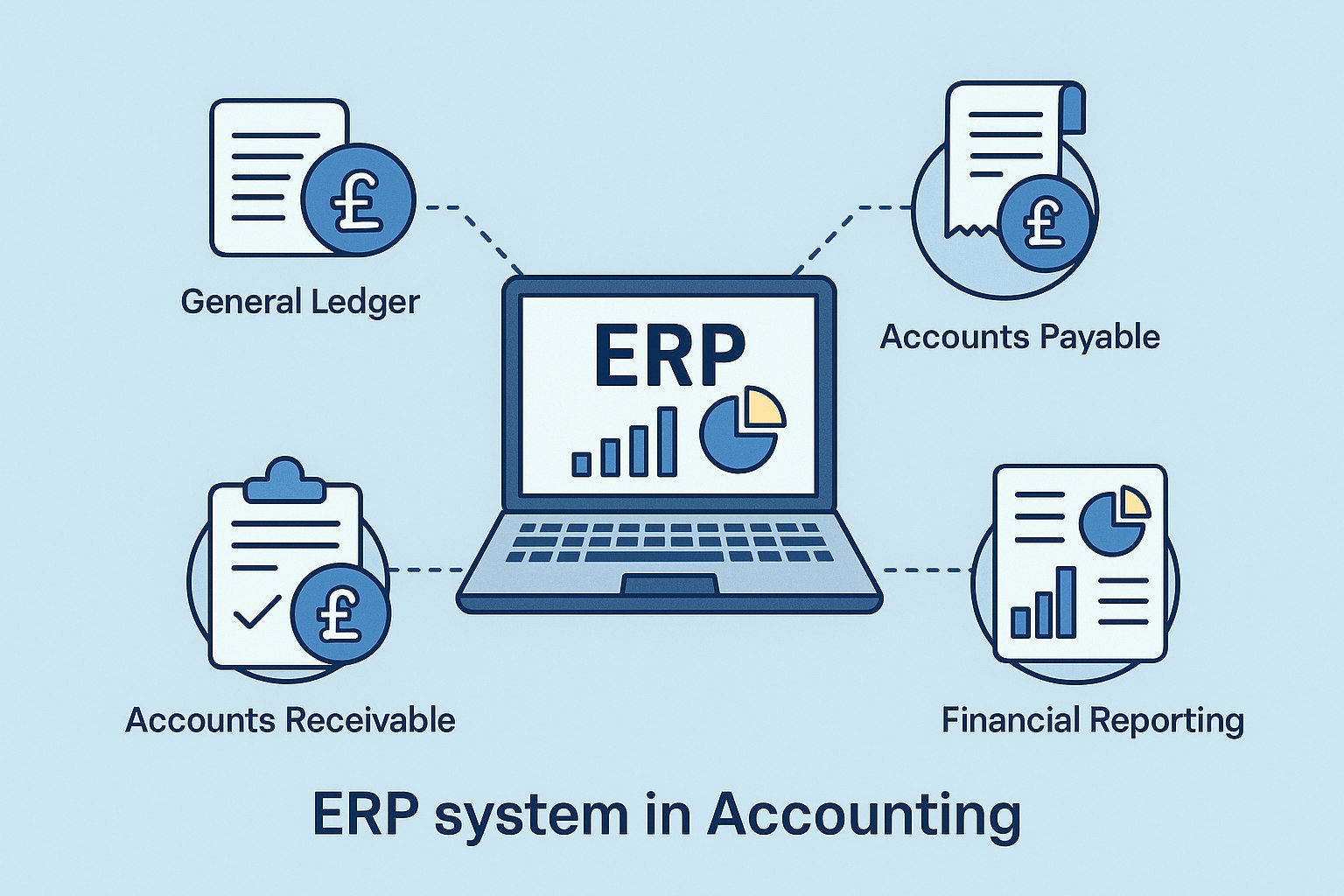

2. Key Components of an ERP System for Accountants

Accounting ERP systems typically include several essential modules. These modules work together to ensure seamless data flow and eliminate redundant tasks:

- General Ledger (GL): The foundation of any accounting system. It consolidates all financial data and produces standard reports such as balance sheets and profit and loss statements.

- Accounts Payable (AP): Tracks money owed to vendors. It helps in managing invoice processing, payment scheduling, and supplier relationships.

- Accounts Receivable (AR): Manages incoming payments and outstanding invoices. This module integrates with CRM tools to track customer payments.

- Fixed Assets Management: Keeps records of company-owned assets, including depreciation schedules, maintenance, and disposals.

- Cash and Bank Management: Allows real-time tracking of bank transactions, reconciliations, and cash flow forecasting.

- Tax Management: Facilitates VAT calculation and compliance reporting.

These modules, when integrated, help businesses maintain financial control while reducing manual interventions.

3. Core Accounting Functions in ERP Platforms

Modern ERP systems offer a range of accounting functions designed to increase accuracy and efficiency:

- Automated journal entries reduce the time spent on manual bookkeeping.

- Multi-currency management enables international businesses to operate without financial discrepancies.

- Audit trails track all transactions, making financial audits more straightforward.

- Bank reconciliation tools allow easy matching of internal records with bank statements.

- Budgeting and forecasting features enable long-term financial planning.

ERP accounting software transforms how financial professionals work by centralising all data and offering sophisticated tools to draw insights.

4. Benefits of ERP for Financial Management

The move to ERP brings a host of benefits that traditional accounting tools often cannot match:

- Enhanced Accuracy: Minimises human errors through automation.

- Real-Time Insights: Allows finance teams to make informed decisions quickly.

- Compliance Assurance: Helps organisations meet financial reporting standards and maintain audit readiness.

- Improved Productivity: Frees up finance professionals to focus on strategic tasks.

- Integrated Data: Eliminates silos by connecting finance with other departments like sales and inventory.

For companies seeking to scale, an ERP for finance is no longer a luxury but a necessity.

5. Comparing ERP Systems with Traditional Accounting Software

Traditional accounting software, such as spreadsheets or standalone applications like Sage or QuickBooks, can serve small businesses adequately. However, these solutions often fall short as the business expands. Here is how ERP accounting systems differ:

- Scalability: ERP solutions grow with the business, handling increased transactions and users effortlessly.

- Interconnectivity: Traditional tools are isolated; ERP integrates every department.

- Automation: Manual data entry is minimised, reducing errors.

- Real-time Reporting: Unlike periodic updates in traditional systems, ERP offers live dashboards.

In short, for businesses aiming to streamline their financial management and reduce overheads, ERP systems offer a far superior framework.

6. Real-world Examples of ERP in Accounting

Let us consider a mid-sized manufacturing company in Lancashire. Before ERP implementation, the business relied on spreadsheets and legacy systems. Financial reports were delayed, inventory costs were rising due to mismanagement, and invoicing errors were common.

After deploying Microsoft Dynamics 365 Business Central through a trusted ERP consultancy in the UK, the company saw immediate benefits. Financial reports became automated and timely, inventory management was integrated with procurement and sales, and compliance reporting became much easier.

Retail chains in Greater Manchester and logistics companies in Merseyside have also benefited from ERP accounting software, improving cash flow management and customer billing cycles.

7. Industry-specific ERP Accounting Solutions

Each industry has unique accounting needs. ERP providers often tailor their offerings accordingly:

- Construction: Requires job costing and project-based accounting features.

- Retail and e-commerce: Benefits from POS integration and real-time sales tracking.

- Healthcare: Needs robust compliance tracking and secure financial data management.

- Non-profits: Require grant management and fund accounting features.

Choosing an ERP that aligns with industry requirements ensures better usability and return on investment.

8. Challenges in ERP Implementation for Finance Teams

While the advantages of ERP are clear, implementation can pose several challenges:

- Cost: ERP systems represent a significant investment, especially for SMEs.

- Training Needs: Staff must be trained to use the system effectively.

- Change Resistance: Finance teams accustomed to legacy systems may resist new processes.

- Data Migration: Transferring data from old systems must be handled with care to avoid errors.

Working with an experienced ERP consultancy can mitigate these risks and ensure a smoother transition.

9. Choosing the Right ERP for Your Accounting Needs

When selecting an ERP for accounting, businesses should consider several factors:

- Business Size and Industry: Larger organisations with complex needs may require more robust solutions.

- Cloud vs On-Premise: Cloud-based ERP systems like Microsoft Dynamics 365 offer flexibility and lower maintenance costs.

- Integration Capabilities: The ERP must integrate well with existing tools and third-party applications.

- Vendor Support: Ongoing support and regular updates are crucial.

Power BI integration is another key consideration. It allows accountants to visualise data and extract insights directly from the ERP system.

10. The Future of ERP in Accounting and Finance

The future of ERP in finance is being shaped by several exciting trends:

- Artificial Intelligence and Machine Learning: These technologies are being used for predictive analytics and anomaly detection.

- Robotic Process Automation (RPA): Repetitive tasks like invoice entry or bank reconciliation are being automated.

- Blockchain: Offers possibilities for more secure and transparent financial transactions.

- Mobile Accessibility: ERP vendors are focusing on mobile-friendly designs to enable remote accounting.

As digital transformation continues to accelerate across the UK, we can expect ERP accounting software to become even more intelligent, user-friendly, and essential.

11. Conclusion

An ERP system in accounting is far more than just a digital ledger. It is a centralised platform that automates financial processes, provides actionable insights, ensures compliance, and integrates with the wider business ecosystem. Whether you are a start-up in Lancashire or an established firm in Greater Manchester, adopting an ERP system tailored to your accounting needs can be a game-changer.

With the right ERP consultancy, UK businesses can successfully navigate implementation challenges and unlock the full potential of accounting ERP systems. From managing day-to-day transactions to driving strategic financial decisions, ERP is the key to modern, agile, and scalable finance management.

Related posts

Visit blog

ISSEY MIYAKE × Apple: The iPhone Pocket That Redefines How We Carry Technology

Looking to make smarter, data-driven decisions? Partnering with a UK Power BI consultancy like NetMonkeys transforms scattered business data into meaningful insights

Smishing vs Phishing vs Vishing: Key Differences Explained

Phishing, smishing, and vishing are evolving faster than ever — and businesses are paying the price. In this expert guide from the NetMonkeys Security Team, we break down how each scam works, why they succeed, and what practical steps you can take to defend your organisation

The Benefits of Working with a UK Power BI Consultancy

Looking to make smarter, data-driven decisions? Partnering with a UK Power BI consultancy like NetMonkeys transforms scattered business data into meaningful insights